The Missing Link Between Marketing and Finance? Smarter Measurement

Imagine pouring millions into marketing, only for your CFO to ask, “What was the actual impact on our bottom line?” This isn’t just a hypothetical scenario, it’s a common struggle for marketers. Marketing teams often report on clicks, ROAS, and impressions, while finance teams prioritize profitability, cash flow, and P&L impact.

This disconnect leaves leadership questioning the true value of marketing investments. Without a credible, finance-friendly measurement framework, marketing risks being seen as a cost center instead of a growth driver.

A smarter approach to measurement is no longer a luxury, it’s a necessity. Let’s break down the roles of each department, the challenges they face, and how you can unify marketing and finance through smarter measurement.

The Connection: Marketing and Finance

Marketing and finance share the same ultimate goal: driving profitable business growth. But a recent study shows that just 22% of CMOs say their partnership with CFOs is truly collaborative.

While marketing focuses on demand generation and customer acquisition, finance is concerned with the financial health and profitability of the business. The link between them is the customer journey itself, from initial awareness to final purchase and lifetime value.

Marketing’s role is to create interest, generate leads, and acquire new customers efficiently.

Finance’s role is to ensure that the cost of acquiring those customers (CAC) is less than the revenue they generate, and that the entire process is profitable and sustainable.

When these two functions sync, they create a powerful engine for growth. Marketing can invest with confidence, knowing their spend is directly contributing to the P&L, while finance can forecast and budget more accurately, based on marketing’s proven impact.

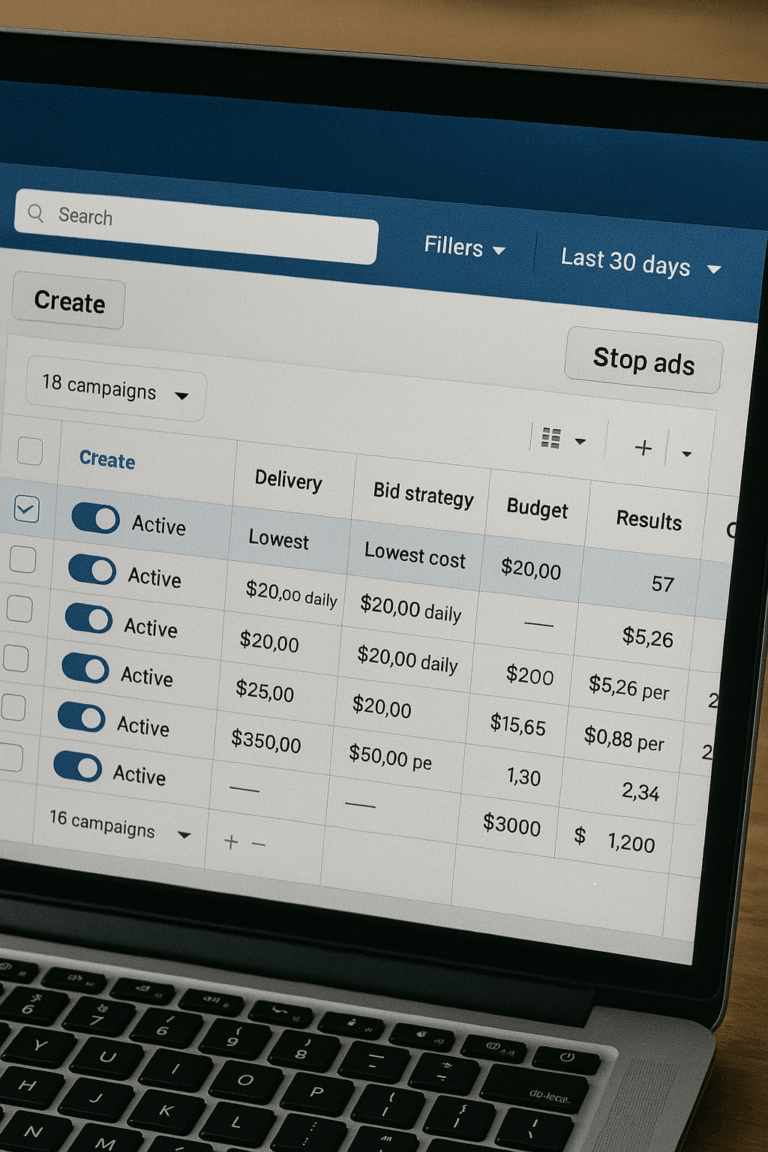

The Challenge: A Disconnect in Language and Goals

The biggest challenge is that marketing and finance often speak different languages. Marketing metrics like clicks, impressions, and ROAS can feel abstract to a CFO focused on the bottom line. This gap can create several problems:

Wasted Ad Spend: Without a clear way to prove genuine incrementality (whether a campaign drove new revenue), ad spend can disappear into the abyss of inflated, in-platform metrics.

Stalled Growth: Finance teams are hesitant to invest in marketing campaigns that lack verifiable ROI data, leading to a stall in growth.

Fragmented Insights: Data is often fragmented across different tools and dashboards, making it difficult to get a single, unified view of performance.

The result is a cycle where marketing feels misunderstood, and finance feels like they’re making decisions in the dark. This is why many brands rely solely on ad platform reporting, which often inflates performance, and skip the crucial step of validating whether those campaigns are actually driving net-new revenue.

Tips for Uniting Marketing and Finance

Unifying marketing and finance requires a strategic shift, moving beyond basic metrics and focuses on building a shared framework for success.

Speak the Language of Finance

To build trust, marketers must start speaking the language of finance. This means understanding and embedding financial priorities directly into the marketing strategy. Instead of just reporting on ROAS, connect your efforts to metrics like:

-

Customer Lifetime Value (LTV): How much profit a customer brings over their entire relationship with the company.

-

Incremental Revenue: The net-new revenue a campaign generated that wouldn’t have happened otherwise.

-

Profitability: The actual profit generated from marketing efforts, after all costs are considered.

Adopt a Full-Funnel Mindset

Cookies are on their way out and marketing’s impact isn’t just about the last click attribution anymore. A full-funnel mindset considers how marketing influences every stage of the customer journey, from initial brand awareness to customer retention.

This approach allows marketers to demonstrate the value of top-of-funnel brand building, not just direct response campaigns, and shows finance how these investments lead to more profitable customers over time.

Prioritize Smarter Measurement

Before diving in, it’s important to note that for these approaches to be successful, brands first and foremost need well-organized data. They’re typically the best fit for companies with at least ~$20M in annual revenue (sometimes $10M+ if there’s strong profit-market fit and a meaningful ad budget).

Smarter measurement isn’t just a dashboard, it’s a comprehensive approach that bridges the gap between marketing and finance. You can do this in a variety of ways:

-

Media Mix Modeling (MMM): This is a powerful statistical analysis that helps you understand the historical impact of all your marketing and non-marketing activities on sales. It’s a CFO-friendly tool because it shows the effectiveness of different channels and helps optimize budget allocation for maximum profitability.

-

Incrementality Testing: This is the gold standard for proving a campaign’s value. By running controlled experiments, you can isolate the impact of a specific campaign and prove whether it drove net-new revenue that wouldn’t have occurred without it.

-

Align Marketing Measurements with CFO Goals: Ensure your marketing dashboards reflect the metrics that matter most to finance, such as profit per customer, cost of customer acquisition (CAC), and payback period. This direct alignment ensures marketing is always talking about its impact on the bottom line, not just its performance within a specific platform.

The Benefits of a Unified Approach

When marketing and finance work together, the entire organization benefits:

For Marketing: You gain clear insights into what’s genuinely moving the needle, allowing for faster optimizations and bulletproof growth strategies that command executive buy-in.

For Finance: You get the confidence that marketing spend drives measurable ROI and P&L-focused reporting that connects marketing directly to business outcomes.

For the Business: The result is unified decision-making, stronger forecasting, and significantly reduced wasted spend.

Aligning marketing and finance isn’t about better numbers; it’s about building a framework for long-term, profitable growth. Ready to start the conversation? Contact us today to learn how.

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.