Chapter 2: MMT Investment Require ments and Budget Planning

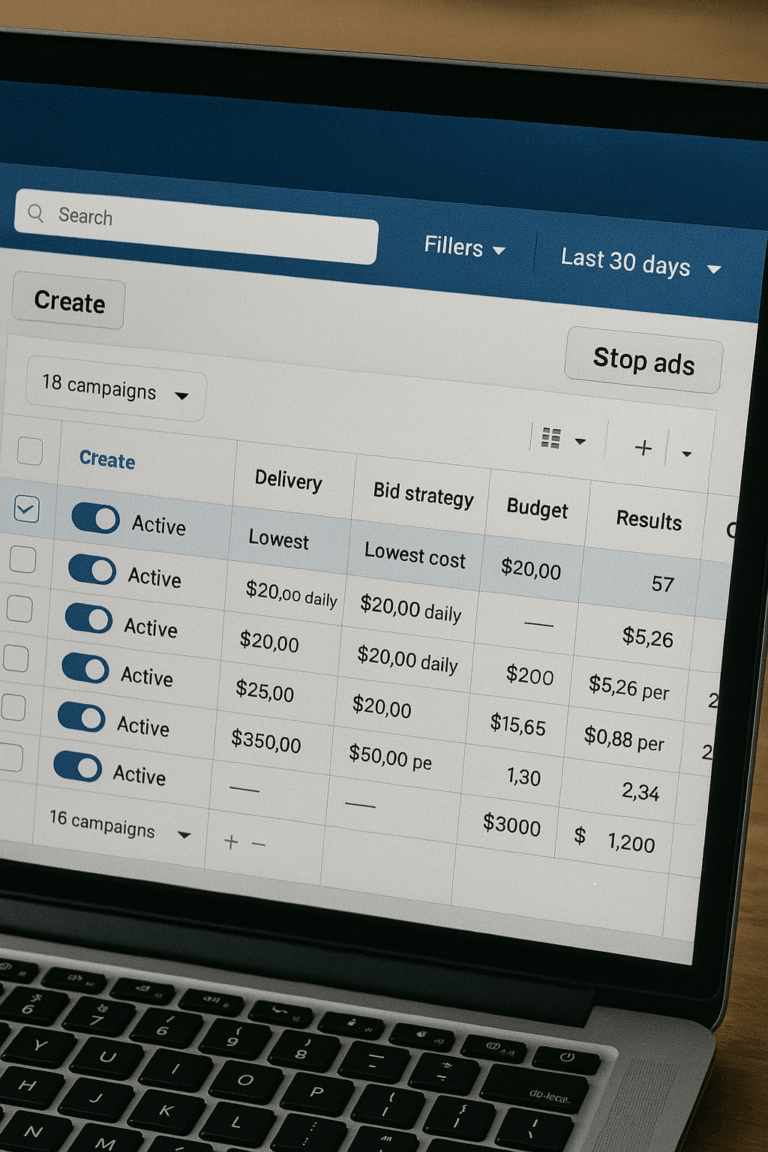

Successful Matched Market Testing requires sufficient spend levels to generate reliable, statistically significant results. Understanding these investment thresholds is crucial for planning effective tests and setting realistic expectations for your measurement initiatives.

Minimum Spend Thresholds

Channel-Level Testing: $20,000+ Monthly Spend

Testing an entire advertising channel (e.g., all Google Ads, all Meta advertising) requires at least $20,000 in monthly spend to generate sufficient signal for reliable measurement.

Examples of Channel-Level Tests:

- Testing all Google Ads performance

- Measuring total Meta advertising effectiveness

- Evaluating complete programmatic display impact

Tactic-Level Testing: $40,000+ Monthly Spend

Testing specific tactics within a channel (e.g., Google Shopping vs. Search, Meta prospecting vs. retargeting) requires higher spend thresholds due to the more granular measurement needed.

Examples of Tactic-Level Tests:

- Google Shopping vs. Google Search performance

- Meta prospecting vs. retargeting campaigns

- YouTube vs. Display within Google ecosystem

- Specific audience segments within a platform

Growth Test Budgets: $20,000+ Monthly Investment

Growth tests require sufficient incremental budget to create measurable lift above natural performance variation.

Investment Considerations:

- Incremental spend above current levels

- Must be large enough to detect meaningful differences

- Higher budgets increase statistical confidence

- Consider platform minimum spend requirements

Why These Minimums Matter

These thresholds ensure statistical power – the ability to detect meaningful changes in performance above normal market fluctuations. Lower spend levels often result in inconclusive tests where the marketing impact is indistinguishable from random variation.

Statistical Power Requirements

- Minimum Detectable Effect: Higher spend allows detection of smaller incremental impacts

- Signal-to-Noise Ratio: Larger budgets create stronger signals above market noise

- Confidence Levels: Adequate spend enables 95% confidence thresholds for decision-making

- Time Efficiency: Higher spend reduces required test duration for conclusive results

Alternative Solutions for Lower Spend

When your current spend levels don’t meet MMT minimums, several alternative approaches can still provide valuable insights:

Media Mix Modeling (MMM)

- Can evaluate channels with lower individual spend by analyzing historical patterns

- Provides holistic view across all marketing activities

- Better for long-term strategic planning

- Requires 1-2 years of historical data

Platform Attribution

- Continue using platform data while understanding its limitations

- Useful for optimization within platforms

- Should be calibrated with periodic MMT when spend grows

- Best for tactical, short-term decisions

Grouped Testing

- Combine multiple smaller tactics into a single test when feasible

- Test related campaigns or channels together

- Aggregate spend to reach minimum thresholds

- Provides directional insights for smaller investments

Risk Management by Test Type

Holdout Test Risk Profiles

Low Risk (5-10% of total business volume):

- Ideal for initial MMT implementation

- Suitable for conservative organizations

- Limited potential revenue impact

- Good for proving MMT value internally

Moderate Risk (10-15% of total business volume):

- Standard approach for established testing programs

- Balances statistical power with business protection

- Suitable for most marketing organizations

- Optimal risk-reward ratio

Growth Test Risk Considerations

Budget Protection Strategies:

- Start with 50-100% spend increases before larger scaling

- Establish clear performance thresholds for continuation

- Plan daily monitoring and quick termination procedures

- Set maximum investment limits before launch

Performance Monitoring:

- Daily revenue and conversion tracking

- Weekly statistical significance checks

- Platform-specific performance metrics

- Competitive activity monitoring

Test Market Size Guidelines

Volume Considerations

- Test Market Coverage: Typically 10-15% of total business volume for optimal balance

- Minimum Volume Thresholds: At least 10 conversions per day or $500 daily revenue per test market

- Control Pool Requirements: Minimum 10-15 potential control markets for robust analysis

Geographic Distribution

- Medium-to-Large Markets: Representative of broader business without being too risky

- Major Market Exclusions: Avoid NYC, LA, Chicago to protect significant revenue streams

- Regional Balance: Ensure test markets don’t over-represent specific regions

Planning Your MMT Investment

Budget Assessment Framework

- Current Channel Spend Analysis: Identify channels meeting minimum thresholds

- Growth Budget Availability: Determine incremental investment capacity

- Risk Tolerance Evaluation: Set maximum acceptable revenue impact

- Timeline Considerations: Plan testing schedule around business cycles

- Resource Allocation: Account for analysis and implementation time

ROI Expectations by Investment Level

$20K-$40K Monthly Tests:

- Clear directional insights

- 80-90% statistical confidence typical

- Suitable for go/no-go decisions

- 4-8 week test durations

$40K+ Monthly Tests:

- High statistical confidence (95%+)

- Detailed optimization insights

- Suitable for scaling decisions

- More granular measurement capabilities

Understanding these investment requirements helps ensure your MMT program delivers reliable, actionable insights that justify the testing investment and drive meaningful business decisions.

Next Steps: Learn how to Interpret MMT results and make scaling decisions

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.