Calculate Customer Lifetime Value (CLV): How to Measure and Maximize ROI

While Customer Acquisition Cost (CAC) measures what it takes to win a customer today, Customer Lifetime Value (CLV) measures what the customer is worth tomorrow.

Most marketing teams can tell you their CAC in seconds, but far fewer can recall the CLV with similar accuracy. The result is predictable: Teams optimize to lower CAC, even if it means acquiring low-value customers who never cover their cost. CLV gets treated like a back-office exercise instead of what it is: the metric that determines whether growth is profitable or just expensive.

Focusing on CAC alone creates a shallow view of growth. CLV, however, shifts the question from “How many customers can we acquire?” to “Which customers are worth acquiring and retaining?”

Let’s see how using CLV as your guiding metric can turn your marketing into a compound investment for your brand.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) is the total economic value a customer generates over the course of their relationship with your business.

A proper CLV calculation accounts for:

-

Churn

-

Retention

-

Gross margin

-

Cost to serve

It turns marketing data into a finance-grade view of customer profitability as seen in these challenges of insurance marketing.

For example, a customer’s first transaction might be $50. But over time, with repeat purchases, upsells, renewals, or referrals, that same customer could yield multiples of their initial spend. The difference between those numbers (and whether you account for the costs along the way) determines whether growth is compounding or eroding.

CLV as a variable

Where many teams go wrong is treating CLV as a static average. They calculate a single blended figure across the entire customer base and proceed.

But CLV is a dynamic metric. It varies sharply by cohort, acquisition channel, and product. Take a subscription business:

-

Customers acquired through organic referrals might renew for three years with minimal service costs.

-

Customers acquired through discount-heavy paid ads might churn after the first renewal and generate thin margins.

Blend those groups and you’ll get a “healthy” average CLV that hides the fact that one channel is quietly burning cash.

This is why CLV is important for both finance and marketing. For CMOs, it reframes acquisition from “cheap leads” to “profitable customers”. For CFOs, it ties marketing back to enterprise value.

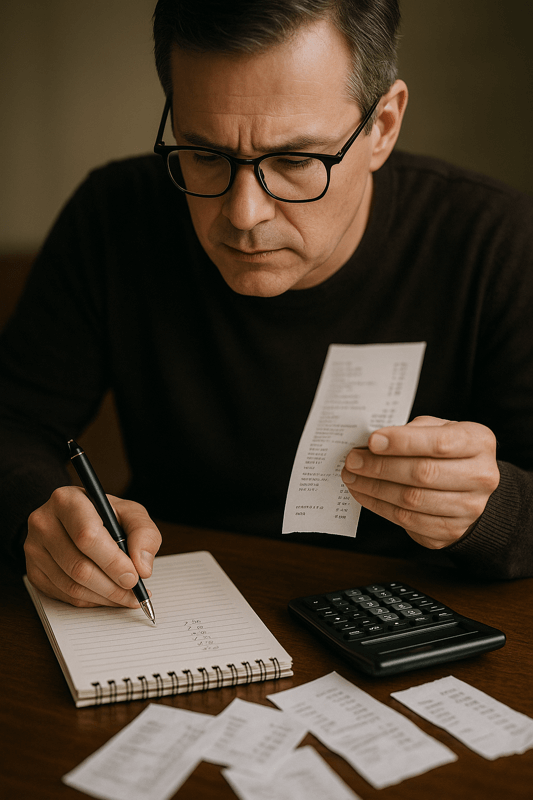

Basic CLV formula (and how to use it)

The most common Customer Lifetime Value formula is:

CLV = (Average Purchase Value × Purchase Frequency × Customer Lifespan) – Cost to Serve

This gives you a quick view of what an “average” customer is worth. For example, if a customer spends $50 per order, makes 5 purchases a year, and stays active for 3 years (with $30 in service costs), their CLV would be $720.

This basic CLV formula serves as a useful starting point. It helps anchor teams on the idea that a customer’s value extends beyond their first transaction.

It also sets a baseline for comparing against CAC. For example, if CAC is $200 and CLV is $720, you’re in positive territory.

However, customers don’t always spend in neat averages. They churn at different rates, generate different margins, and require different levels of support, making advanced models of how to calculate customer lifetime value necessary.

Customer Lifetime Value Calculator

Customer Lifetime Value: $

Historical CLV vs predictive CLV

From an accounting view, historical CLV totals the revenue and margin a customer has already delivered. It’s often useful for reporting on what a cohort or channel has contributed to date.

On the other hand, predictive CLV advances the metric. Instead of stopping at what happened, it estimates value based on behavioral signals, retention curves, and margin patterns.

-

For retail, it could model how often specific customer segments are likely to repurchase, and at what basket size.

-

In SaaS, it can account for contract renewals and probability-weighted upsell paths.

Segment-based CLV calculations

Segmenting CLV by cohort, acquisition channel, or customer type reveals which groups drive disproportionate value.

-

Customers acquired through referrals tend to have high retention rates and lower service costs.

-

Paid search customers might deliver quick revenue but lower margins after discounts.

-

In SaaS, enterprise customers often generate far higher CLV than SMBs, but with longer payback windows.

The segmentation method for calculating CLV prevents the problem of averages. Instead of being misguided by a blended number, you can double down on profitable cohorts and rethink strategies for low-value ones.

Why CLV matters for ROI and growth strategy

On its own, CLV is incomplete. The metric gains meaning when tied directly to CAC and payback.

Linking CLV to CAC and payback

When CAC indicates the amount spent to acquire a new customer, CLV tells you what that customer returns. The ratio between the two (often ranging from 2:1 to 8:1 for mature businesses) is the simplest way to check whether growth is profitable.

If it costs $400 to acquire a customer worth $500, the math doesn’t work. If that same customer is worth $2,000 over their lifetime, a higher CAC can be acceptable.

Payback period adds another layer of complexity. Even if CLV is high, cash flow suffers if it takes years to recover CAC. A 12-month payback might be tolerable for enterprise SaaS, while for consumer subscriptions, the tolerance is often just three to six months.

Prioritizing high-value customer segments

Importantly, not all customers compound value the same way.

-

Some generate a healthy margin and renew predictably.

-

Others churn fast or buy only when discounts are deep.

Segment-level CLV exposes these differences.

Keep in mind that acquisition spend isn’t free. If you spread the budget evenly, you’ll overinvest in low-value cohorts while underserving the ones that could fuel long-term growth. With segment-level CLV, you can rationalize spend and double down on profitable customers.

In practice, this is what ties marketing back to ROI.

Common mistakes in CLV calculation

CLV is less about the math and more about the assumptions behind it. That’s where most teams go wrong.

Ignoring churn or retention

-

Cohort decay – This refers to the decline in value as customer groups age.

-

Churn curves – These map the probability of a customer remaining active over time.

-

Survival analysis – This approach delves deeper, using statistics to estimate how long different types of customers are likely to remain.

Using revenue instead of margin

A customer who spends $1,000 but generates only $200 in gross margin is far less valuable than the topline suggests. CLV must be built on margin if it’s going to hold up under CFO or investor scrutiny.

Treating all customers as equals

Blended averages blur the signal. A single CLV number across the entire base ignores differences in channel, cohort, or product line. This can hide loss-making segments inside an otherwise “profitable” average. Segment-based CLV avoids this trap by surfacing where value is truly created.

When these mistakes creep in, CLV becomes a feel-good number that looks impressive in decks but fails in its primary purpose: acting as a growth compass.

Maximizing CLV with predictive analytics

So, how do you build CLV models that withstand scrutiny and inform business decisions? This is where predictive analytics comes into play.

Leveraging customer profitability analysis

Revenue tells you what you brought in. Profitability shows you what remains.

Predictive models that incorporate gross margin, service costs, and retention behavior separate “high-spend, low-margin” customers from those who actually compound value.

Using our earlier example, let’s consider two customers who both spend $1,000.

-

One nets $700 in gross margin with steady renewals.

-

The other generates $200 after discounts and high support costs.

Without profitability analysis, both look identical. With it, the difference is clear—and so is where you should invest.

Forecasting lifetime value under different scenarios

Predictive CLV also makes it possible to stress-test the strategy, with questions like:

-

What happens if churn improves by 5%?

-

Should we reduce discounts by 10%?

-

Is it profitable to shift our acquisition strategy toward referral-based cohorts instead of paid ads?

CLV scenario modeling allows you to simulate these changes before committing funds.

CLV as a compass for durable, profitable growth

While the compass of CLV doesn’t tell you every detail of the terrain, it does point you in the right direction: toward customers who create lasting value and away from those who drain it. Ultimately, without CLV, businesses risk investing heavily but heading in the wrong direction.

At fusepoint, we help brands put this compass to work.

-

We start with advanced CLV modeling, using dynamic models that account for churn, margin, and segment-level differences.

-

From there, we layer in incrementality testing to validate those models in the real world, giving you proof of which strategies create true lift.

-

Finally, we tie it all together with media mix modeling, so CLV helps you with creating a media plan for the full marketing portfolio.

Our approach is diagnostic: We identify what’s broken in your measurement, why it’s happening, and how to fix it so that leadership can make more informed decisions.

If your current measurement strategy leaves you guessing, it’s time for a more efficient system that points the way forward. fusepoint offers marketing performance consulting and financial modeling services to put CLV at the center of your growth strategy today.

Sources

McKinsey & Company. Experience-led growth: A new way to create value. https://www.mckinsey.com/capabilities/growth-marketing-and-sales/our-insights/experience-led-growth-a-new-way-to-create-value

PwC. Customer Lifetime Value (CLV): Maximising Profits and Shaping Customer Relationships. https://www.pwc.com/cz/en/risk-management-and-modelling/CLV_Final.pdf

McKinsey and Company. Customer lifetime value: The customer compass. https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/customer-lifetime-value-the-customer-compass

First Page Sage. SaaS CAC Payback Benchmarks: 2025 Report. https://firstpagesage.com/reports/saas-cac-payback-benchmarks/

ResearchGate. Customer Lifetime Value in B2B Markets: Theory and Practice in the Czech Republic. https://www.researchgate.net/publication/312952094_Customer_Lifetime_Value_in_B2B_Markets_Theory_and_Practice_in_the_Czech_Republic

Harvard Business Review. The Flaw in Customer Lifetime Value. https://hbr.org/2007/12/the-flaw-in-customer-lifetime-value

MDPI. A New 360° Framework to Predict Customer Lifetime Value for Multi-Category E-Commerce Companies Using a Multi-Output Deep Neural Network and Explainable Artificial Intelligence. https://www.mdpi.com/2078-2489/13/8/373

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.