How to Navigate Marketing in a Time of Market Uncertainty

As new tariffs roll in and market uncertainty rises across global markets, brands are bracing for another wave of budget scrutiny. When financial markets shift and market volatility spikes, marketing spend is almost always the first line item questioned. But the instinct to immediately slash brand, prospecting, and measurement budgets can hurt long-term performance far more than it helps short-term cash flow.

Here’s why—and how to navigate smarter in periods of economic uncertainty and unstable market conditions.

The Typical Response in a Downturn

In every cycle of heightened uncertainty, the same pattern emerges.

First goes brand spend:

“We can’t measure it—cut it.”

“Shift everything to performance.”

“Our brand ROAS looks terrible in dashboards.”

Then top-of-funnel channels disappear:

Prospecting budgets evaporate

Display shuts off

Video and CTV go dark

Finally, measurement gets deprioritized:

Testing stops

Incrementality budgets shrink

Data and modeling projects get delayed

This reaction is understandable when market participants are nervous, consumer confidence softens, and leadership feels pressure to mitigate downside risk. But it’s also directly at odds with how to grow through uncertain times.

The 95–5 Rule: What Most Brands Miss

Only 5% of your audience is in-market at any moment. The other 95% aren’t buying today but will in the future. When brands pull back during periods of market uncertainty or stock market volatility, they lose visibility with that future demand. Competitors who maintain presence—especially during high uncertainty—capture the long-term market share others unknowingly give up.

Brand marketing doesn’t operate on the same time horizon as a fluctuating stock market or week-to-week performance fluctuations. It shapes perception, recall, and category preference. Cutting it removes the foundation of your next revenue cycle.

Why Cutting Brand Spend Hurts Growth

At fusepoint, we see this across multiple industries and market cycles. When brands retreat too aggressively, they lose not just awareness but also efficiency and momentum. Eliminating brand and TOF spend teaches your media engine to focus solely on the lowest-hanging fruit, which eventually dries up—especially when consumer spending slows or inflation expectations rise.

When companies also pause measurement, they lose insight into which channels are truly driving lift. That means more waste, more blind spots, and weaker alignment with evolving market sentiment and customer behavior.

The Smarter Path: Optimize, Don’t Eliminate

1. Get Clear on Incrementality

In periods of market volatility, teams need clarity—not guesses. Incrementality measurement shows which channels truly drive lift versus those merely harvesting demand created elsewhere.

At fusepoint, we run:

-

Synthetic control experiments

-

Geo-holdouts

-

Incremental CAC analyses

These give brands a clearer picture of where to cut without harming growth.

2. Use MMM to Understand How Channels Work Together

Marketing Mix Modeling reveals the interplay between channels, helping marketers see the halo effect performance dashboards miss. It’s especially valuable when navigating shifting market expectations, inflationary pressures, or unpredictable demand cycles.

Feeding incrementality learnings back into the MMM creates an adaptive system—one that adjusts to economic shifts, evolving consumer spending, and changing market conditions.

3. Distinguish Acquisition From Cannibalization

When budgets tighten, it’s critical to identify which channels add net-new customers and which simply capture users who would have converted anyway. In volatile markets, every dollar must go toward channels that expand demand, not cannibalize it.

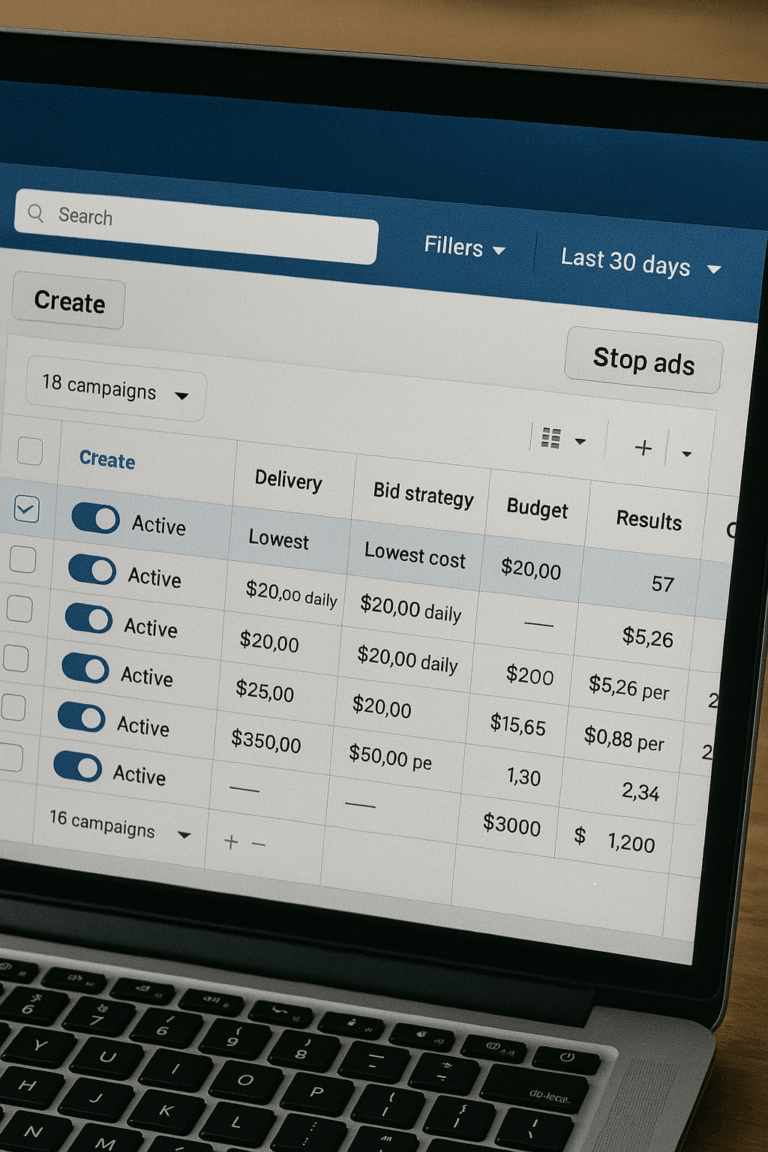

4. Pressure-Test Before Pulling the Plug

Instead of shutting off channels entirely during periods of market uncertainty, test controlled reductions:

-

Lower frequency caps

-

Renegotiate partner rates

-

Test smaller threshold budgets

We’ve seen brands cut 30% of spend while retaining over 90% of their performance simply by reallocating with precision.

fusepoint’s Role in Times of Market Uncertainty

fusepoint exists to provide clarity when market cycles are unstable and leadership teams are facing complex decisions. We’re not another performance agency—we’re an objective measurement and strategy partner focused on helping brands:

-

Validate their media mix

-

Diagnose waste

-

Design custom incrementality frameworks

-

Make smarter decisions during periods of volatility

During moments of heightened uncertainty, brands need a partner who can translate data into action—not more noise.

Don’t Go Dark When Markets Get Uncertain

In downturns, the brands that win aren’t the ones who cut the deepest. They’re the ones who cut with intention, invest strategically, and measure relentlessly. As market uncertainty increases, clarity becomes a competitive advantage.

If you want to understand what’s working, what’s wasting spend, and where to reallocate in volatile conditions, schedule a measurement assessment with fusepoint.

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.