Why Your Omnichannel Marketing Strategy Needs More Than Software

- 1. The Platform Gap: When Good Tools Can’t Deliver a True Omnichannel View

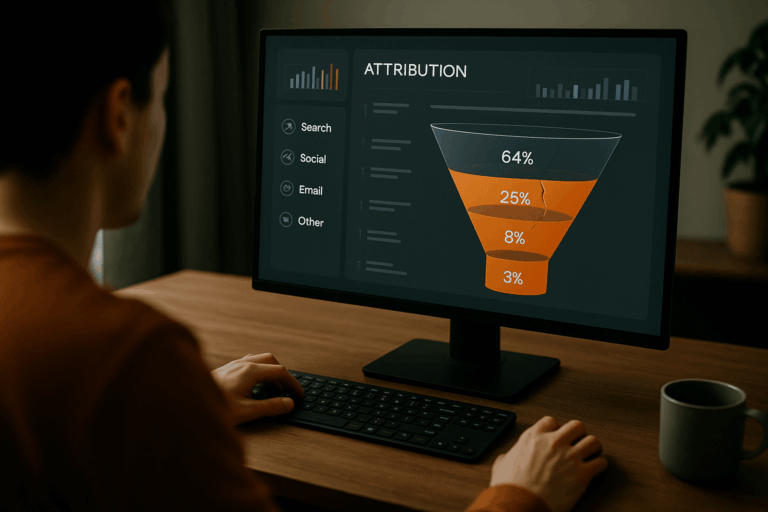

- 2. Is Your Measurement Slowing Down Your Omnichannel Strategy?

- 3. Why Omnichannel Brands Are Re-Evaluating Measurement

- 4. Measurement Isn’t the Finish Line—It’s the Starting Point

- 5. What Brands Actually Need From Their Omnichannel Marketing Partner

- 6. Moving Forward: Build an Omnichannel Strategy That Supports Growth

Omnichannel isn’t a buzzword. It’s the reality of how modern brands operate. Today’s marketers are managing digital marketing, retail, Amazon, email marketing, social, CTV, marketplaces, and emerging platforms—all while under pressure to justify every marketing dollar. A successful omnichannel marketing strategy demands visibility across every customer touchpoint, yet most teams are still making high-stakes decisions with only partial context.

The problem isn’t effort. It’s the tools.

The Platform Gap: When Good Tools Can’t Deliver a True Omnichannel View

Most platforms promise clarity, but few reflect the full omnichannel customer journey. Brands often come to us with the same concerns:

-

Why does Meta say one thing and GA something else?

-

Why did ROAS dip even though engagement and conversion volume stayed steady

-

How do we evaluate performance when customers interact across multiple sales channels?

These questions exist because most marketing reporting platforms weren’t designed for a holistic omnichannel approach. They weren’t built to integrate customer data from both digital and physical store environments, nor to understand how cross-channel marketing influences behavior over time.

Here’s where they fall short:

Rigid models

Many tools use standardized frameworks, which limits the personalization needed to reflect unique customer preferences or complex multichannel marketing structures.

Channel bias

Click-based attribution undervalues upper-funnel channels critical for customer engagement, brand awareness, and long-term customer loyalty.

Resource assumptions

Platforms expect internal teams to interpret nuanced outputs, activate insights across every marketing channel, and maintain consistent branding with limited bandwidth.

Offline blind spots

When in-store purchases, events, or offline influence matter, measurement becomes incomplete—and the omnichannel experience suffers.

The result is a fractured view of marketing performance, even when teams are working hard to create a seamless customer experience.

Is Your Measurement Slowing Down Your Omnichannel Strategy?

You may need more than a dashboard if:

-

Platform metrics conflict

-

You can’t see how online and retail impact each other

-

ROAS looks good, but customer lifetime value doesn’t move

-

Upper-funnel and offline channels are under-represented

-

Your team spends more time reporting than thinking about budget allocation

When this happens, it’s not a failure—it’s a signal that your current setup isn’t built for a true omnichannel marketing strategy.

Why Omnichannel Brands Are Re-Evaluating Measurement

As customer expectations evolve and cross-channel marketing becomes the norm, teams need a measurement system that reflects real-world customer behavior, not just on-platform events.

Common challenges we hear include:

-

How do we connect performance across digital, retail, social, and streaming?

-

How do we ensure measurement reflects business outcomes, not just clicks?

-

How do we turn insight into action when bandwidth is limited?

-

A successful omnichannel strategy requires both unified customer data and the ability to activate insights across marketing campaigns—not just dashboards.

Measurement Isn’t the Finish Line—It’s the Starting Point

For many brands, the breakthrough isn’t collecting more data. It’s transforming that data into an actionable omnichannel marketing strategy. Platforms excel at reporting what happened, but they rarely guide your next move.

You still need answers to questions like:

-

Should you shift budget from paid search to retail media?

-

Does your brand messaging align across every customer interaction?

-

Where does personalization break in the customer journey?

-

Which customer segments drive the highest customer lifetime value?

Without strategic support, these decisions remain guesswork.

What Brands Actually Need From Their Omnichannel Marketing Partner

Across hundreds of conversations with mid-market and enterprise brands, three needs come up repeatedly:

Clarity amid complexity

A unified view of customer data across all marketing channels, removing silos between digital and physical store environments.

Tailored insights

Context-aware recommendations that match your audience behavior, customer segments, and omnichannel efforts—not generic best practices.

Support in activation

Turning measurement into action through scenario planning, creative strategy, channel allocation, and communication between marketing and finance.

This is the foundation of an effective omnichannel marketing strategy, not just an omnichannel reporting stack.

“Software can’t see the full picture. It can’t interpret offline nuance or guide strategic pivots. That’s where fusepoint steps in. We help brands cut through noise, interpret data in context, and move with confidence.”

— Mallory Wilberding, Director of Sales, fusepoint

Moving Forward: Build an Omnichannel Strategy That Supports Growth

The strongest brands aren’t the ones with the most data—they’re the ones that know what to do with it. A successful omnichannel marketing strategy blends data, context, and execution to create a seamless customer experience across every channel.

If your measurement approach isn’t keeping pace with how your customers move across digital, retail, and everything in between, it’s time to rethink your omnichannel approach.

fusepoint helps brands unify insights, optimize omnichannel efforts, and turn marketing data into action that compounds across the entire customer journey.

If you’re ready to modernize your omnichannel strategy, let’s talk.

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.