Incremental ROAS in TOF: Why “Low” Can Still Be a Win

- 1. Quick Definitions (for shared language)

- 2. Why TOF Often Shows “Low” Incremental ROAS

- 3. How to Set Up TOF Incrementality Tests That Read Clean

- 4. Interpreting iROAS (and Avoiding Common Traps)

- 5. A Simple iROAS Calculation (so teams align on math)

- 6. Benchmarks to Set Expectations (directional, not dogma)

- 7. How TOF iROAS Should Inform Your Budget Decisions

- 8. Common Pitfalls That Drag iROAS Down (and how to fix them)

- 9. What a “Promising” TOF Read Looks Like

- 10. Bringing It Together (so your team can act)

When marketers test top-of-funnel (TOF) campaigns—YouTube, TV/CTV, OOH—incremental ROAS (iROAS) often comes back “low.” That tends to spook teams used to platform-reported ROAS. The truth: low iROAS is normal for TOF and does not mean the campaign failed.

After running 1,200+ incrementality tests and thousands of models across industries, we see the same pattern: TOF iROAS looks modest in the short run and improves as exposure compounds, consideration cycles play out, and downstream channels convert the new demand. What matters is why iROAS looks low, how you set up the test, and how you interpret results in a brand-building context.

Quick Definitions (for shared language)

-

TOF campaigns: Awareness/consideration tactics (TV/CTV, YouTube, OOH, prospecting video).

-

iROAS (Incremental ROAS): Incremental revenue ÷ incremental ad spend (iRev / Spend). This isolates incremental revenue beyond baseline, not total sales.

-

Growth tests: Add spend on top of the current plan (often show lower iROAS because they measure marginal return at the edge of your current spend level).

-

Holdout/on-off tests: Remove or pause spend in a test region and measure the loss (often show higher iROAS because they capture the value of removing a base layer of media).

Rule of thumb: Growth tests measure marginal ROAS; holdout testing estimates the value of your base. Expect different numbers—and resist comparing them 1:1.

Why TOF Often Shows “Low” Incremental ROAS

1) New channels need time to mature

Net-new channels don’t hit peak efficiency on week one. They need time to:

-

Reach enough of the right audience (coverage).

-

Stabilize CPMs and inventory quality.

-

Build mental availability and associations that convert later via search, direct, and retail.

2) Windows are too short for long consideration cycles

Most incrementality experiments run 4–8 weeks; some go to 12. TOF effects build slowly and spill over after the test ends (carryover/adstock). We routinely see iROAS improve post-test as the audience exposed during the test converts over weeks and months.

Illustrative progression (growth test):

-

Week 4 (in-test): iROAS ≈ $0.25

-

Week 8 (in-test): iROAS ≈ $0.50

-

Week 12 (post-test): iROAS ≈ $1.00

-

Week 24 (post-test): iROAS ≈ $3.00

For higher-consideration categories, half (or more) of the impact can accrue months after exposure. Short windows undercount the true incremental return.

3) TOF lifts other channels you’re not crediting

TOF often manifests as branded search, direct load, retail lift, or higher site-wide conversion rate—places that cross-channel marketing attribution rarely assigns to the TOF campaign. If your test readout only looks at last-click or platform metrics, you’ll miss a chunk of incremental value.

4) Diminishing returns show up at the margin

Growth tests probe the edge of your current spend level. If you’re already heavily invested in a channel or audience, the next dollar has a lower marginal return. That’s the point: iROAS helps you decide whether to push, hold, or reallocate at the margin.

How to Set Up TOF Incrementality Tests That Read Clean

1) Include a meaningful post-treatment window

Keep measuring iROAS for weeks (ideally months) after the flight ends. Your readout plan should include:

-

In-flight effect (weeks 1–8/12)

-

Short-lag effect (weeks 12–24)

-

Medium-lag effect (up to 6–12 months for big-ticket categories)

2) Ensure reach & frequency are actually sufficient

TOF works by building memory structures. Thin delivery won’t move incrementality. As a baseline:

-

Reach ≥ 15% of your target in the exposed geo,

-

Hold ~2+ weekly frequency, sustained throughout the test.

If you can’t reliably hit R+F, don’t expect measurable incremental lift.

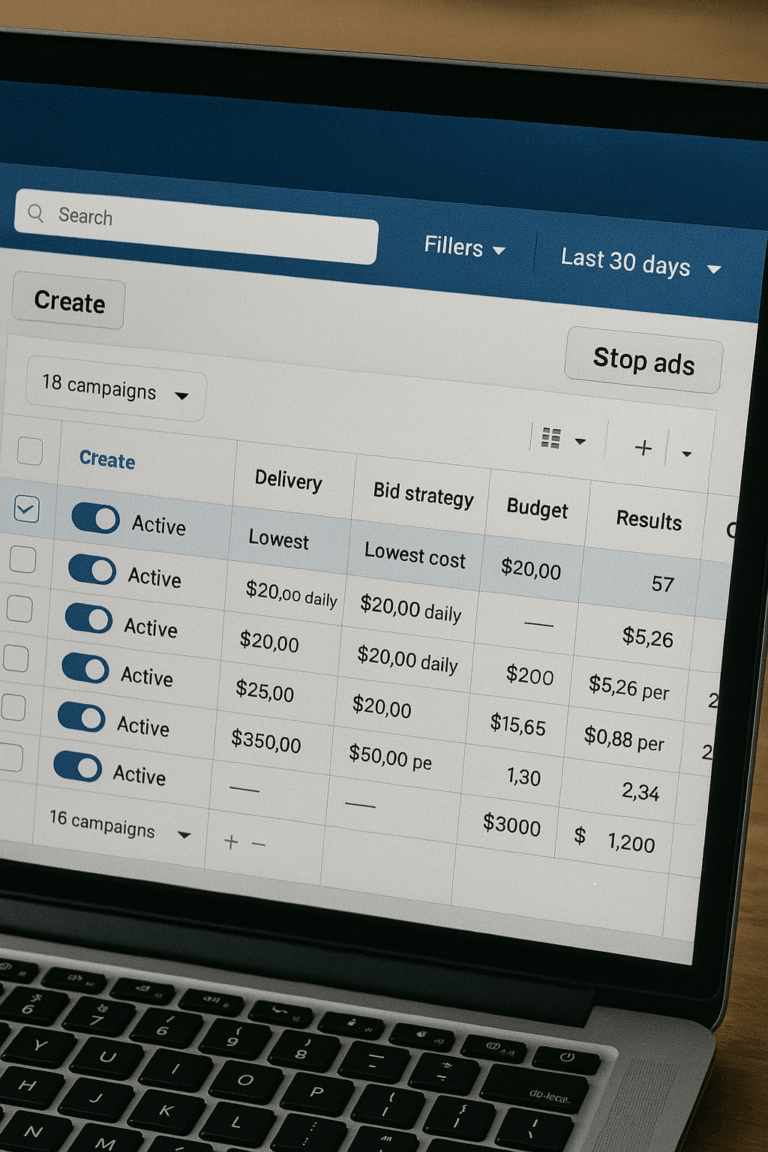

3) Pick the right test design for the question

-

Geo on/off (synthetic control): Reads total business impact.

-

Time-based on/off: Useful when geo-gating is impossible; requires robust seasonality controls.

-

Audience holdout: Feasible in some platforms; mind cross-contamination risk (shared households/cookies).

Pair tests with MMM solutions to quantify spillover into search/retail and to simulate different budget allocation scenarios.

4) Predefine success bands and confidence

Decide in advance what “good” looks like:

-

Floor (p90 lower bound): e.g., iROAS ≥ $0.25 during test.

-

Projected blended (12–24 weeks): e.g., iROAS ≥ $1.00–$3.00 based on category.

-

Confidence interval targets (≥90%) and minimum detectable effect (MDE).

A modest, positive floor now + a credible uplift trajectory later is often a green light to keep investing.

Interpreting iROAS (and Avoiding Common Traps)

iROAS vs. traditional ROAS

-

Traditional ROAS: Attributed revenue / spend (often over-credits clicks and lower funnel).

-

Incremental ROAS: Incremental revenue / incremental spend (what changed because of the campaign). When they disagree, plan with iROAS—it represents the true impact.

Average vs. marginal iROAS

-

Average iROAS: Total incremental return across all dollars.

-

Marginal iROAS: Return on the next dollar.

Budget decisions should be made at the margin; use marginal iROAS curves to decide whether to add, hold, or cut.

Holdout vs. growth tests

Expect higher iROAS from holdouts than growth tests. Holdouts remove a base layer with proven return; growth tests add on the edge. Don’t label a channel “bad” because the growth-test iROAS < holdout iROAS.

Read the full funnel, not a single metric and validate that TOF is doing TOF things:

-

Upper funnel: ad recall, search interest, branded query share.

-

Mid funnel: engaged sessions, view-through conversions, assisted conversions.

-

Lower funnel: new-to-brand revenue, incremental sales in target geos, retail velocity.

If upper-funnel movement is strong but revenue lags, consider extending the measurement window before declaring it.

A Simple iROAS Calculation (so teams align on math)

-

Baseline (control) revenue over period: $10.0M

-

Exposed revenue over period: $10.6M

-

Incremental revenue (iRev): $0.6M

-

Incremental ad spend: $0.3M

-

iROAS = $0.6M / $0.3M = 2.0

Now add a 12-week post-treatment read: if incremental revenue continues at $0.2M with no added spend, your blended iROAS over the full horizon rises to (0.6 + 0.2) / 0.3 = 2.67. This is why post-treatment matters.

Benchmarks to Set Expectations (directional, not dogma)

-

Net-new TOF growth tests: It’s common to see iROAS between $0.2–$1.0 in-test, improving over the following quarters.

-

Holdout tests on established TOF: Often read higher (they’re removing proven base).

-

High-consideration or long sales cycles: Expect longer lags and wider confidence intervals; plan for 12–18 months to see full payback.

Benchmarks are context-dependent—category margins, distribution mix (retail vs. DTC), and creative quality all matter. Use them to frame, not to judge.

How TOF iROAS Should Inform Your Budget Decisions

1) Use iROAS to shape marginal spend

Map each channel’s marginal iROAS curve. If TOF marginal iROAS clears your contribution hurdle (after lag), add gradually. If it’s below, troubleshoot R+F, creative, and geo fit before cutting.

2) Re-credit spillover correctly

Many TOF wins show up as branded search or retail lift. Pair your tests with MMM to re-attribute a fair share of that additional revenue back to TOF in your roll-ups.

3) Sequence creative and audience

Incremental return rises when creative is memorable and targeted at new-to-brand audiences with sufficient frequency. Dull creative or broad delivery depresses campaign effectiveness and iROAS reads.

4) Think portfolio, not hero channel

A “low” TOF iROAS can still be valuable if it meaningfully reduces CAC in performance channels or increases conversion rate for mid-funnel. Optimize the portfolio iROAS, not single-channel vanity.

Common Pitfalls That Drag iROAS Down (and how to fix them)

-

Under-delivery on R+F: Fix with tighter geo, dayparting, or inventory selection.

-

Too-short tests: Extend duration and add a defined post-treatment analysis.

-

Messy geography: Use contiguous DMAs and exclude bleed-over zones.

-

Contamination: Prevent cross-channel promotions in control regions.

-

Narrow readouts: Include retail, branded search, and direct load in the KPI set.

-

Creative fatigue: Refresh concepts regularly; TOF lives or dies on salience.

What a “Promising” TOF Read Looks Like

Even if your in-test iROAS is “low,” you likely have a win if you see:

-

Positive p90 floor (e.g., 90% CI lower bound > $0).

-

Strong upper-funnel movement (recall, branded queries).

-

Improving post-treatment iROAS trend.

-

MMM showing uplift in search/retail tied to exposed geos.

Example you cited: YouTube test with 90% CI iROAS = $0.25–$1.50 in-test. That’s a green light to keep nurturing the channel and read again at 12–24 weeks post-flight.

Bringing It Together (so your team can act)

-

A “low” TOF incremental ROAS is expected in growth tests—judge it over the right horizon.

-

Design for reach, frequency, and maturity, not just minimum spend.

-

Pair incrementality testing with media mix modeling to capture spillover and plan budget allocation at the margin.

-

Make decisions with marginal iROAS curves, not platform ROAS.

-

Keep a structured readout: in-flight, short-lag, medium-lag.

If you want help designing cleaner tests, sizing post-treatment effects, or translating iROAS into portfolio-level profitable growth, we can partner on the right framework and the reads.

Our Editorial Standards

Reviewed for Accuracy

Every piece is fact-checked for precision.

Up-to-Date Research

We reflect the latest trends and insights.

Credible References

Backed by trusted industry sources.

Actionable & Insight-Driven

Strategic takeaways for real results.